Accounting for small businesses is highly important yet it is often ignored at the same time. Running a successful small business requires properly tracking your finances. Implementing basic accounting can sound intimidating, but it doesn’t have to be complicated. This comprehensive guide breaks down easy-to-understand accounting essentials for non-accountants.

Accounting 101: Key Principles Made Simple

Standard accounting guidelines create reliable processes for tracking transactions. Small businesses should focus on mastering these core principles first:

- The Matching Principle: Expenses must be matched to related revenue in the same reporting period to accurately reflect margins. This prevents underreporting costs.

- Revenue Recognition: Revenue gets recorded when sales transactions are finalized, regardless of whether customer payments have been received yet. This stops income underreporting.

- Consistent Methodology: Using consistent accounting techniques year-over-year allows for fair financial comparison. Only change methods if new standards substantially improve reporting.

Must-Have Accounting Financial Statements for a Small Business

Accounting produces key financial statements providing visibility into the health of a small business. Learn about these crucial reports:

- Income Statements: Summarizes revenues, expenses, and profit/loss over a set timeframe. Monitor for sales dips or cost spikes.

- Balance Sheets: Snapshot of assets, liabilities, and equity at a set moment. Compare weights of assets vs liabilities to assess financial stability.

- Cash Flow Statements: Tracks actual cash flowing in and out from operating, investing, and financing activities. Quantifies small business liquidity.

- Retained Earnings Statements: Details cumulative profit kept or reinvested over time. Bridges net profit to equity changes on balance sheets.

Understanding Accounting Cycles for a Small Business

Accounting cycles for small businesses are essential frameworks that ensure accurate financial management and reporting. These cycles typically include several key steps:

- Recording Transactions: Small businesses record financial transactions such as sales, purchases, expenses, and receipts in their accounting system. This step involves capturing all relevant information to maintain complete and accurate records.

- Journal Entries: Transactions are then classified and summarized into journal entries. Each entry includes details such as date, account name, and amount, reflecting the dual aspect of accounting (debit and credit).

- Posting to Ledgers: Journal entries are posted to respective ledger accounts, organizing transactions by account type (e.g., cash, accounts receivable, accounts payable). This step helps in tracking balances and preparing financial statements.

- Trial Balance: Periodically, a trial balance is prepared to ensure that debits equal credits, verifying the accuracy of ledger entries. Any discrepancies are identified and corrected before proceeding.

- Adjusting Entries: At the end of the accounting period, we make adjustments to reflect accruals, deferrals, depreciation, and other necessary adjustments to accurately represent financial performance and position

- Financial Statements: Based on adjusted trial balances, financial statements like the income statement, balance sheet, and cash flow statement are prepared. These statements provide insights into business performance, financial position, and cash flows.

- Closing Entries: At the end of the accounting period, we close temporary accounts such as revenue, expenses, and dividends to retained earnings to start the next accounting period with zero balances.

- Post-Closing Trial Balance: A post-closing trial balance is prepared to ensure that only permanent (or real) accounts remain open, ready to record transactions for the next period.

By following these accounting cycles diligently, small businesses can maintain accurate financial records, comply with regulatory requirements, make informed decisions, and drive long-term success.

An ERP Solution’s Accounting Feature can provide a Small Business with

- Accounting Dashboards: Modern accounting systems feature intuitive dashboard views summarizing key small business financial metrics all in one place for rapid insights. Customize dashboards to spotlight sales, profits, accounts receivable, inventory turnover, cash flow, and other KPIs vital for your operations.

- Forecasting Tools For Better Planning: Robust accounting software enables smart financial planning through flexible budgeting and forecasting tools. Set expense allocation budgets across departments while predicting future revenue based on seasonal trends and growth initiatives. This supports more accurate hiring, inventory purchasing, and cash flow decisions.

- Secure Cloud Collaboration: Cloud-based accounting software allows secure access to essential data for both external accountants and internal team members. Collaboration tools like shared notes, timestamps, and task assignments foster transparency on information requests and project status without extensive email chains.

- Payment Processing Integrations: Many small business accounting platforms allow connecting merchant services to sync revenue deposits, fees, and chargebacks directly into the books. As customer payment methods expand across credit cards, debit cards, mobile wallets, and even cryptocurrency, some accounting systems keep up with seamless integration.

Easy Accounting Tips For Small Business Owners

Follow these simple tips for stress-free financial tracking:

- Automate Everything Possible: Accounting software, mobile check deposits, and online client invoicing remove manual errors.

- Standard Checklists: Checklists for payroll, inventory audits, taxes, etc ensure recurring compliance tasks don’t slip through the cracks.

- Separate Personal and Business: Use dedicated small business bank accounts and credit cards only. Don’t mix personal finances.

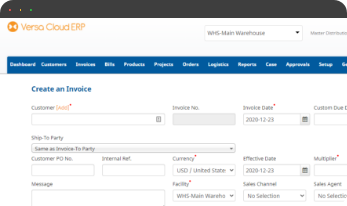

Versa Cloud ERP’s all-in-one solution can solve the Accounting woes of a Small Business

- What are the benefits of accounting software?

Increased organization, accuracy, and efficiency. Mobile access, inventory control, digital invoicing, payroll, and reporting save an enormous time. - How often should a small business prepare financial statements?

Small businesses should generate key reports like income statements, balance sheets, and cash flow statements monthly. Annual statements are critical. - What are strategies to improve small business accounting organizations?

Process automation, standardized checklists, and separating personal and business transactions greatly improve accounting cleanliness. - Why should small businesses have dedicated financial accounts?

Mixing business and personal finances obscures documentation and reporting. Dedicated accounts simplify tracking and compliance.

Understanding the fundamentals empowers small business owners to effectively track finances, enabling growth and sustainability. While accounting software greatly simplifies processes, identifying the right solution matched to your operations gets tricky with the sea of options.

Versa Cloud ERP offers a powerful, customizable, and affordable platform tailored to your specific business needs. See firsthand how Versa centralizes accounting, inventory, orders, payroll, dashboards, intelligent reporting, and much more. Consult 1:1 with our small business accounting experts and experience how Versa Cloud ERP optimizes workflows while remaining easy to use, even for non-accountants.

Schedule a free, no-strings-attached customized demo today to learn why leading small and midsize businesses trust Versa Cloud ERP to efficiently manage critical back office tasks so they can focus on customers and grow revenue.

Empower your business with the knowledge to navigate the realm of an Integrated ERP solution, specifically tailored to inventory and warehouse management and POS needs. Gain insights, streamline processes, and propel your financial management to new heights with this comprehensive guide

With Versa Cloud ERP’s Implementation guide learn how a business can ensure a successful ERP Solution Implementation. Navigate the complexities of implementation with confidence!

A Small Business in the modern day with Omnichannel Retail is complex and requires resources to deliver on its goals and achieve its full potential. To create a small business success story business owners need an ERP Solution that grows with them.

Effectively manage your financials, accounting, inventory, production, and warehouse management workflows with our award-winning ERP.

Let Versa Cloud Erp’s do the heavy lifting for you.

Do Business on the Move!

Make your businesses hassle-free and cut the heavyweights sign up for the Versa Cloud ERP today!!

Join our Versa Community and be Future-ready with us.