The Accounting feature in an ERP Solution serves as the backbone of any business, providing the framework for tracking financial transactions, analyzing performance, and making informed decisions. It’s more than just number crunching; it’s the language of business, translating complex financial data into meaningful insights.

Accounting is often associated with images of boring number crunching and tedious form filling. However, the knowledge of basic concepts and accounting practice plays a valuable role in financial storytelling for businesses and individuals alike. At its heart, accounting is simply about recording and tracking money flows so people can understand what is happening with it. Don’t let the jargon scare you off, the concepts themselves are quite straightforward. Let’s explore some accounting basics everyone should know to take the mystery out of the subject!

Follow the Money Trail

Every business functions through continuous cycles of money coming in and money going out. Accounting gives you ringside seats to the action so you know where your money stands. It’s like having a GPS for your financial position! The accounts provide a map to analyze the money trails in, out, and through your business. Want to know why the bank balance doesn’t match your registered receipt? Accounting has answers!

The Language of Business

Ever felt lost when your accountant started throwing around terms like “amortization” or “deferred taxes”? Accounting has its own vocabulary for naming financial components. Learning some keywords opens up understanding. “Assets” represents economic resources (things you own that have value) while “Liabilities” indicates debts or obligations owed. “Equity” refers to the owner’s stake or assets minus liabilities. Expenses are the costs of doing business while Revenues reflect income earned. Get familiar with these building blocks to grasp accounting conversations better!

ERP Solution Harmonizes Accounting Processes: Crunching with a Purpose

Accounting quantifies money into numeric terms – but its purpose extends beyond playing with numbers. The goal is to produce useful financial information that provides insights into the business. Want to know if you’re profitable or heading towards trouble? The Income Statement has you covered. Need to check if you have enough money to pay vendors? The Balance Sheet offers answers. Like a translator, accounting converts financial complexities into straightforward statements anyone can understand.

Income Statements Track Performance

While balance sheets showcase financial position, income statements reveal performance over a period of time. They tally all revenue earned and subtract related expenses to calculate net income for the term. Comparing revenues and profitability historically and against projections helps assess progress. Granular departmental income statements can also expose problem areas needing management intervention. Alongside balance sheets, they provide indicators of operating success.

Cash Flows Demonstrate Liquidity

Positive income statement profits don’t necessarily mean liquid cash available to fund operations. The Statement of Cash Flows highlights timing differences between reported revenues/expenses and actual cash inflows/outflows. It categorizes sources and uses of cash across the business, investing, and financing activities. While income statements gauge profitability, cash flow statements assess liquidity essential for funding growth. Together these reports present a comprehensive financial picture.

Accrual vs. Cash Basis

Businesses can use either accrual or cash-based accounting. Accrual accounting recognizes revenues when earned and matches expenses to them, regardless of when cash changes hands. This provides a fuller economic view aligned with GAAP standards for financial reporting. Cash basis only records actual cash receipts and payments without allocating across periods. Its simplicity benefits some small businesses, but accrual better informs business decisions through faithful adherence to the revenue matching principle.

Telling a Story with Meaning

At its core, accounting aims to tell a financial story about where a business stands. And like any good story, much thought goes into developing the plotline and getting the facts right. Accounting has strict rules and guidelines to ensure the data presented is reliable, consistent, and accurate. Adhering to industry-wide standards also facilitates comparisons with other business stories so you know where you stand among the crowd. Think of accounting like a narrator offering a trustworthy, qualitative financial play-by-play full of meaning.

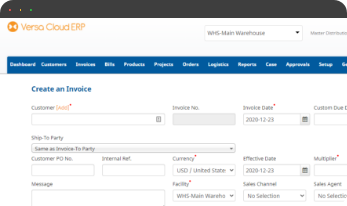

Bringing It All Together: Versa Cloud ERP Solution Harmonizes Accounting Processes

Like a control center, Versa Cloud ERP pulls together all the vital accounting processes into one unified system. This integrated platform automates key functions from journal entries to financial reporting, providing real-time visibility into money matters. Built-in analytics transform raw data into actionable business insights. With user-friendly customization aligned to industry norms, Versa Cloud ERP brings accounting down to earth. Ready to seamlessly manage finances? Schedule a free demo today to experience simplicity and elevate profitability with Versa Cloud ERP.

Empower your business with the knowledge to navigate the realm of an ERP solution, specifically tailored to accounting needs. Gain insights, streamline processes, and propel your financial management to new heights with this comprehensive guide

With Versa Cloud ERP’s Implementation guide learn how a business can ensure a successful ERP Solution Implementation. Navigate the complexities of implementation with confidence!

A Small Business in the modern day with Omnichannel Retail is complex and requires resources to deliver on its goals and achieve its full potential. To create a small business success story business owners need an ERP Solution that grows with them.

Effectively manage your financials, accounting, inventory, production, and warehouse management workflows with our award-winning ERP.

Let Versa Cloud Erp’s do the heavy lifting for you.

Do Business on the Move!

Make your businesses hassle-free and cut the heavyweights sign up for the Versa Cloud ERP today!!

Join our Versa Community and be Future-ready with us.