Elevate your budgeting process with Versa Cloud ERP-integrated budget solutions. Streamline financial planning, allocate resources efficiently, and gain insights for informed decision-making across your organization

Why is Budgeting Important for Businesses?

Budgeting is the cornerstone of any successful business. It provides a roadmap for managing resources and a lens for analyzing performance. But its true power lies in the insights it reveals.

With a budget, you can track income and expenses to identify cash flow trends. You’ll spot issues before they emerge and take proactive steps. Budgeting also facilitates cost control, allowing you to optimize spending and maximize profits.

Budgeting provides several critical benefits for businesses:

1. Financial Planning and Forecasting

Budgets forecast expected revenues and costs to anticipate liquidity needs for operational and growth requirements. This enables advanced preparation.

2. Cost Management

By allocating the budget to business units and expense categories, costs can be monitored, controlled, and reduced to improve profitability.

3. Performance Benchmarking

Comparing actual expenditures across departments and periods with budgeted amounts enables performance evaluation and progress tracking.

4. Informed Decision Making

With projected numbers around business scenarios, budgets empower leaders to make smart investment decisions aligned to growth strategies.

Types of Business Budgets

Operating Budget

The operating budget forecasts the upcoming period’s core business income and operating expenses. It includes:

- Projected Sales or Revenues: Expected earnings from products or services sales based on historical performance, growth strategies, and market analysis.

- Direct Costs: Variable expenses like raw materials, wages, and commissions that vary proportionally to production volumes.

- Fixed Costs: Expenses unaffected by volume such as rental, utilities, salaries, and insurance premiums.

- Overheads: Indirect expenses like administration, security, and ancillary service costs critical for operations.

Other Essential Budgets

In addition, specialized budgets may be required for business functions like:

- Marketing Budgets: Project advertising and promotion expenses across channels and campaigns to define the marketing mix.

- Capital Expenditure Budget: Prepare asset investment plans for facility expansions, tools, machinery, R&D etc. aligned to growth needs.

- Cash Flow Forecast: Project cash inflows and outflows timing to ensure sufficient working capital availability for financial health.

How ERP Streamlines and Optimizes Budgeting

Traditional manual methods are disconnected, reactive, and resource-intensive. In contrast, ERP (Enterprise Resource Planning) software has revolutionized budgeting by seamlessly automating tasks, unifying data, and powering proactive planning with embedded analytics.

Core Benefits and Functionalities:

- Centralized Cloud Platform: An integrated centralized database on the cloud consolidates expenses, revenue, and operational data enterprise-wide for a single source of truth.

- Real-Time Visibility: Inbuilt analytics offer real-time insights into budget vs actuals across business units empowering data-backed decisions vs intuition.

- Workflow Automation: Workflows for purchase approvals, budget requests, status alerts, etc. are configurable no-code templates that automate routine manual processes.

- Unified Data: All systems and modules integrate natively on ERP eliminating risky mismatched data from disparate sources causing budget inaccuracies.

- Oversight and Controls: Embedded KPIs, notifications and restrictions on spending, legal limits on overages, etc. enable oversight for budget discipline.

- Forecasting and Modelling: Sophisticated forecasting mechanisms leverage historical trends and data models to accurately plan future budget needs.

- Scalability: Cloud-based ERP easily scales up as transaction volumes grow ensuring optimized performance in budgeting complexities.

Streamlining Departmental Budgets

- Sales and Revenue: Attain clarity on sales pipeline health with integrated CRM data to budget revenue more precisely factoring in customer lifecycle stage probability.

- Inventory Management: Get dynamic inventory analytics – stock levels, replenishment needs, and carrying costs – from ERP to optimize capital allocation.

- Payroll: Integrate HR, attendance, leave, and payroll data seamlessly to configure policies and automate salary, benefits, and tax planning.

- Project Accounting: Manage project budgeting holistically factoring in tasks, milestones, resource usage, and dynamic business needs for accurate costing.

- Procurement: Enforce approval chains and contract visibility with alerts on exceptions to optimize procurement budgets and cash outflow.

- Manufacturing: Get granular production costing data from shop floor IoT and operations for accurate activity-based budgeting minimizing surplus allocation.

- Regulatory Compliance: Stay audit-ready with controls around taxation, and financial compliance requirements within ERP to avoid budget overruns from fines.

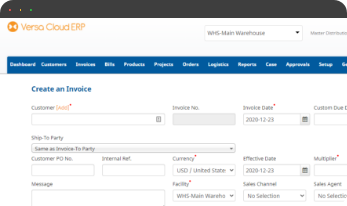

Optimize Budgeting with Versa Cloud ERP

Enterprise Resource Planning (ERP) software has tremendous potential to revolutionize and optimize budgeting processes for businesses. By consolidating enterprise-wide financial and operational data onto a unified cloud platform, robust ERP software like Versa Cloud ERP eliminates silos and fragmented systems that have historically inhibited accurate and integrated budgeting.

Embedded real-time analytics provide invaluable visibility, configurable workflows automate manually intensive processes from purchase approvals to budget change requests, saving valuable time and resources.

To experience the benefits firsthand, we encourage you to schedule a free demonstration of Versa Cloud ERP. See how a truly unified budgeting and planning platform can unlock new potentials for your organization’s growth and prosperity.

Q&A’s

Q1. How does centralized data in ERP improve budget accuracy?

Centralized data provides a single source of truth showing the full picture across departments – avoiding risky mismatched Excel numbers. Real-time analytics also improve accuracy with up-to-date data vs periodic reporting.

Q2. What typical budgeting challenges does workflow automation address?

Automation through workflows eliminates manual errors from tedious repetitive calculations. It also provides a structure for standardized policies around approvals and changes. This reduces confusion and ensures consistency critical for budget discipline.

Q3. How does ERP facilitate collaboration during the budgeting process?

ERP facilitates seamless collaboration during budgeting by allowing all involved departments and roles to access relevant real-time budget data and status updates. Configurable alerts and approvals keep the right people informed.

Q4. What are some typical budgeting tasks automated by ERP software?

Typical automated tasks include expense allocations, budget vs actual variance analysis, status reports and notifications, budget modification workflows, cash flow forecasts, salary projections based on hiring plans, and inventory budgeting using supply/demand data.

Q5. How can ERP systems help companies scale and adapt their budgeting?

ERP systems help future-proof budgeting with flexible modeling of growth scenarios and forecasts based on historical data. As companies scale, increased transaction volume is handled optimally. Changes to business plans are quickly incorporated into budgets for continuous adaptation.

Effectively manage your financials, accounting, inventory, production, warehouse management, order management, and other operations of your Shopify Store workflows with our award-winning ERP.

Let Versa Cloud Erp’s do the heavy lifting for you.

Empower your business with the knowledge to navigate the realm of an Integrated ERP solution. Gain insights, streamline processes, and propel your accounting management to new heights with this comprehensive guide.

With Versa Cloud ERP’s Implementation guide learn how a business can ensure a successful ERP Solution Implementation. Navigate the complexities of implementation with confidence!

A Small Business in the modern day with Omnichannel Retail is complex and requires resources to deliver on its goals and achieve its full potential. To create a small business success story business owners need an ERP Solution that grows with them.

Do Business on the Move!

Make your businesses hassle-free and cut the heavyweights sign up for the Versa Cloud ERP today!!

Join our Versa Community and be Future-ready with us.