Unlock the potential of your business with our Guide on the Essentials of Accounting in an ERP solution, designed to optimize financial management processes.

In the world of accounting, two fundamental concepts play crucial roles in managing a company’s financial health: accounts receivable and accounts payable.

Accounts receivable represent the money owed to a company by its customers for goods or services provided on credit. On the other hand, accounts payable signifies the amounts that a company owes to its suppliers or creditors for purchases made on credit. Together, these components form the backbone of a company’s financial transactions, reflecting its incoming and outgoing cash flows. Proper management of accounts receivable and accounts payable is essential for maintaining liquidity, managing cash flow effectively, and sustaining healthy business operations.

Essentials of Accounting in an ERP Solution: Accounts Receivables

Accounts receivable refers to the money owed to a business by its customers or clients for goods or services provided on credit. This represents a crucial aspect of a company’s finances, reflecting the amount of revenue it has earned but has not yet received in cash. Managing accounts receivable effectively involves tracking outstanding invoices, following up on overdue payments, and ensuring timely collection to maintain healthy cash flow.

The balance sheet lists the total value of all accounts receivable as current assets, encompassing invoices that clients owe for items or work performed for them on credit.

Typically, businesses invoice customers after providing services or products based on mutually agreed-upon terms outlined in contracts or sales orders. These terms often range from net 30 — meaning customers agree to pay invoices within 30 days — to net 60 or net 90, which a company may accept to secure a contract. For large orders, a company may request a deposit upfront, especially for made-to-order products. Services firms also commonly bill a portion of their fees upfront.

As a company completes the delivery of the goods or services to the client, the Accounts Receivable (AR) sends an invoice to the customer and records the invoiced amount as an accounts receivable, specifying the terms.

Journal Entry (Credit Sales)

Accounts Receivables A/c Debit

To Sales A/c Credit

If the client pays according to the agreed terms, the team records the payment as a deposit, marking the account as no longer receivable. However, if the customer fails to pay on time the AR or collections team may send a dunning letter, which could include a copy of the original invoice and detail any late fees incurred.

Journal Entry (Cash Received for Credit Sales)

Cash/ Bank A/c Debit

To Accounts Receivables A/c Credit

Utilizing the accounting feature of an all-in-one ERP Solution businesses can enhance their days’ payable metrics by automatically emailing customers regarding overdue invoices and requesting immediate payment.

The Accounting Feature of an ERP also provides the Business with detailed information on individual accounts or all past-due accounts for comprehensive reporting on customer information, invoice details, due dates, amounts owed, and credit terms.

Essentials of Accounting in an ERP Solution: Account Receivable Ratios

- Debtor turnover Ratio also known as the accounts receivable turnover ratio or receivable turnover, assesses how efficiently and promptly a company transforms its accounts receivable into cash during a specific accounting period. The AR turnover rate for one year appears as follows:

Net annual credit sales/average accounts receivables = Accounts receivables turnover

- Current Ratio also known as working capital, gauges liquidity by assessing whether a company can meet short-term obligations using available cash or other liquid assets convertible into cash within a year.

Working capital ratio = current assets/current liabilities

- Days Sales Outstanding (DSO) indicates the average time it takes for customers to pay your company for goods and services

Days sales outstanding = accounts receivable for a given period/total credit sales X number of days in the period

Essentials of Accounting in an ERP Solution: Accounts Payables

A business’s accounts payable consist of the amounts it owes to suppliers and other creditors for items or services purchased and invoiced. Accounts payable does not encompass items such as payroll or long-term debt like a mortgage.

Journal Entry (Purchase of Goods)

Inventory A/c Debit

To Accounts Payables A/c Credit

Journal Entry (Cash Paid for Purchases)

Accounts Payable A/c Debit

To Cash/Bank A/c Credit

Accounts payable are typically recorded upon receipt of the bill, following the payment terms agreed upon by both parties during the transaction initiation or the purchase order terms. When the business receives a valid bill for goods and services, it records it as a journal entry and posts it to the general ledger as an expense. After the bill is approved and payment is issued according to the contract terms, such as net 30 or net 60 days, the accounting team records the expense as paid.

A robust AP practice contributes to business success by maintaining accurate cash forecasts, minimizing errors and fraud, and providing reports for business leaders and external stakeholders.

Essentials of Accounting in an ERP Solution: Account Payables Ratios

- Days Payables Outstanding (DPO) is a financial metric that measures the average number of days it takes a company to pay its suppliers or creditors for goods and services purchased on credit.

Average accounts payable = accounts payable balance at beginning of period – ending accounts payable balance/2

DPO = average accounts payable/cost of goods sold x number of days in the accounting period.

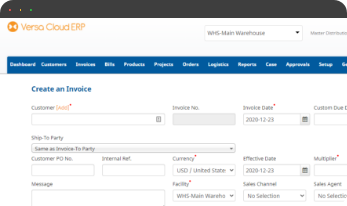

Accounting Feature of Versa Cloud ERP

Versa Cloud ERP offers a comprehensive accounting feature designed to streamline financial management for businesses. With versatile functionalities, businesses can streamline tasks such as invoicing, expense tracking, and financial reporting. The platform offers real-time insights into cash flow, allowing businesses to make informed decisions promptly.

Versa has Accounts Receivables and Accounts Payables features that include:

- Batch Pay

- Bill Pay

- Aging

- Deposits

- eChecks

- Batch Receipt

- Payment Receipt

- Deduction/Adjustments

- Returns/Refunds

- ACH

- Credit Cards

- E-mail/Print Statements

- Dunning

Automate business processes, maximize productivity and accelerate growth. Discover the Versa solutions to your modern business needs.

Empower your business with the knowledge to navigate the realm of an Integrated ERP solution, specifically tailored to inventory and warehouse management and POS needs. Gain insights, streamline processes, and propel your financial management to new heights with this comprehensive guide

With Versa Cloud ERP’s Implementation guide learn how a business can ensure a successful ERP Solution Implementation. Navigate the complexities of implementation with confidence!

A Small Business in the modern day with Omnichannel Retail is complex and requires resources to deliver on its goals and achieve its full potential. To create a small business success story business owners need an ERP Solution that grows with them.

Effectively manage your financials, accounting, inventory, production, and warehouse management workflows with our award-winning ERP.

Let Versa Cloud Erp’s do the heavy lifting for you.

Do Business on the Move!

Make your businesses hassle-free and cut the heavyweights sign up for the Versa Cloud ERP today!!

Join our Versa Community and be Future-ready with us.