What if we told you that you could access these reports anytime, anywhere, with real-time updates with the Financial Statements in an all-in-one ERP solution?

What is a Financial Statement?

A financial statement is a formal document that provides a comprehensive summary of the financial activities, performance, and position of a business entity.

It typically includes key information such as income, expenses, assets, liabilities, and equity, presented in a structured format for easy interpretation and analysis. Financial statements are crucial tools for stakeholders, including investors, creditors, and management, to assess the financial health and viability of a company. Common types of financial statements include the balance sheet, income statement, cash flow statement, and statement of changes in equity.

Financial Statements in an ERP Solution

Balance Sheet:

A financial statement that provides a snapshot of a company’s financial position at a specific point in time. It presents assets, liabilities, and equity, showing the company’s resources, debts, and ownership interests.

Income Statement (Profit and Loss Statement):

A financial statement that reports a company’s revenues, expenses, and net income (or loss) over a specific period. It highlights the company’s financial performance by showing how much money it earned and spent during the period.

Cash Flow Statement:

A financial statement that shows the inflows and outflows of cash and cash equivalents over a specified period. It categorizes cash flows into operating, investing, and financing activities, providing insights into a company’s liquidity and cash management.

Trial Balance:

A report that lists all the general ledger account balances of a company at a specific point in time. It helps ensure the accuracy of the accounting records by verifying that debits equal credits.

General Ledger:

A master record that contains all the financial transactions of a company, organized by account. It serves as the foundation for creating financial statements and provides a complete record of a company’s financial activities.

Accounts Payable Aging Report:

A report that lists all outstanding accounts payable invoices along with their due dates, categorizing them based on the length of time they have been outstanding. It helps businesses manage their payable obligations and prioritize payments.

Accounts Receivable Aging Report:

A report that lists all outstanding accounts receivable invoices along with their due dates, categorizing them based on the length of time they have been outstanding. It helps businesses monitor and collect overdue receivables.

Budget vs. Actual Report:

A report that compares actual financial results with budgeted or forecasted amounts, highlighting variations between the two. It enables businesses to evaluate performance, identify areas of improvement, and make informed decisions.

Financial Ratios Analysis:

A set of calculations and comparisons derived from financial statements to assess a company’s financial performance, position, and health. Ratios may include profitability ratios, liquidity ratios, leverage ratios, and efficiency ratios, providing insights into different aspects of a company’s operations.

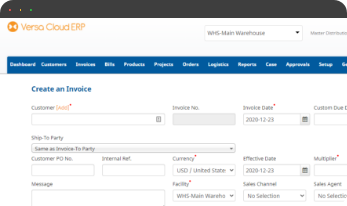

Effortlessly Track Financials with Versa Cloud ERP

Versa Cloud ERP offers robust features for generating various financial statements. These include balance sheets, income statements, cash flow statements, and more. In addition, Versa also can assist the business in building custom financial reports giving users the information they need that is tailor-made for their business.

Financial reports serve as crucial tools for assessing the financial health, performance, and stability of a business. By providing valuable insights into revenue, expenses, cash flows, and other key metrics, these reports enable informed decision-making and strategic planning. As an integral part of business operations, the generation and analysis of financial reports are essential for achieving long-term success and sustainability.

Empower your business with the knowledge to navigate the realm of an ERP solution, specifically tailored to accounting needs. Gain insights, streamline processes, and propel your financial management to new heights with this comprehensive guide

With Versa Cloud ERP’s Implementation guide learn how a business can ensure a successful ERP Solution Implementation. Navigate the complexities of implementation with confidence!

A Small Business in the modern day with Omnichannel Retail is complex and requires resources to deliver on its goals and achieve its full potential. To create a small business success story business owners need an ERP Solution that grows with them.

Effectively manage your financials, accounting, inventory, production, and warehouse management workflows with our award-winning ERP.

Let Versa Cloud Erp’s do the heavy lifting for you.

Do Business on the Move!

Make your businesses hassle-free and cut the heavyweights sign up for the Versa Cloud ERP today!!

Join our Versa Community and be Future-ready with us.