Understanding the Invoice

An invoice does much more than say thanks for the money. It is a multi-tasking document that helps businesses work together smoothly. By spelling out the nitty gritty of a deal and asking for payment, an invoice lets companies easily track their financial back-and-forth. This chapter will explore how invoices are essential tools that protect the money and legal parts of business agreements

What is Invoice?

At its core, an invoice is a bill a seller sends a buyer with the 4Ws of a commercial hookup – who, what, when, and how much. It lists the products or services provided, associated costs, tax rates, preferred ways to pay, and total owed. Unlike a receipt that just confirms payment after the fact, an invoice formally requests compensation for goods/services before payment. It basically says, “We agreed on this, that’s the agreed price, now it’s time to pay up.”

More Than Paper

You may think invoices are just paperwork, but they do much more behind the scenes. These days, emails and apps let businesses say thanks digitally. So why do invoices still matter?

Keeping Financial Records Straight

Invoices help sellers keep organized financial books by linking each deal to detailed documentation. Instead of relying on memory or messy spreadsheets, sellers have formal invoices listing all the deal details to keep accounting accurate.

Facilitating Tax Compliance by Documenting Transactions

In addition to organizing seller accounts, invoices help facilitate buyer tax compliance. By providing an itemized formal record of purchase details, description of goods/services, and amount paid, invoices simplify expense reporting and deductions during tax season.

Establishing a Clear Understanding Between Buyer and Seller Regarding the Agreed-Upon Costs

Finally, invoices minimize financial misunderstandings by clearly stipulating the commercial terms both parties have consented to. Any discrepancies can be promptly clarified before payment finalization. This prevents unnecessary conflicts.

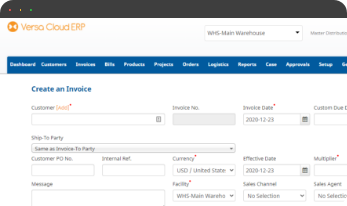

Learn how to create an Invoice with Versa Cloud ERP

Understanding Key Components of Invoice

Now that we have explored the critical functionality of invoices, let’s examine their composition. A standard invoice contains structured components that systematically capture all transaction specifics.

Structure of Invoice – Essential Elements

Although invoice formats can vary, most share common elements that divide details into clear, comprehensive sections. Core components include.

- Unique invoice number/ID

- Date of issuance

- Seller’s legal name and contact information

- Buyer’s name and contact information

- Itemized descriptions of goods/services provided

- Applicable tax rates

- Preferred payment methods and due date

- Final amount owed by Buyer

Additional sections like discounts, shipping fees, or personalized notes may be incorporated as needed.

Dissecting the Invoice – A Line-by-Line Exploration

Now, let’s explore the functionality of these key invoice components more closely:

- Unique Invoice Identifier

The distinct invoice number enables easy identification and reference for record-keeping and follow-up. Sequential numbering helps systematically track invoices. - Invoice Date

This documents the formal date of issuance. Payment due dates are often calculated based on set intervals after this date. - Seller Information

The seller’s legal business name, address, contact details, and tax ID number identify their business while facilitating communication and verification. - Buyer Information

In addition to the buyer’s name and contact information, their shipping address is also included if physical product delivery applies. - Description of Goods/Services

A detailed, itemized description of products sold or services rendered enables accurate verification of what is being billed for. Details like quantity, unit price, associated discounts, and line totals provide clarity. - Taxes, Discounts, Additional Fees

If applicable, taxes, discounts, shipping fees, and any other charges are itemized here for transparency. - Total Amount Due

This final invoice total accounts for the subtotal plus all applicable taxes, less any discounts or incentives, plus additional charges accrued. - Payment Terms

This outlines the due date, acceptable payment methods, and late fee details to inform buyers and facilitate on-time payment.

Invoice Customization – Accommodating Variations

While all invoices share common components, businesses may customize certain sections to accommodate industry-specific norms, complex transactions, or local regulations. For example, a contractor may include more detailed project deliverable breakdowns whereas an online retailer may emphasize shipping-related details.

As long as the document clearly conveys transaction specifics to request payment, businesses have the flexibility to tailor invoice content and structure without compromising legitimacy and functionality.

Simplifying Invoice Creation Step-by-Step

Creating professional, accurate invoices may seem daunting, especially for smaller companies without robust accounting teams. However, breaking down the process helps simplify invoice generation.

Gathering Information – Preparing the Foundation for Your Invoice

Before drafting the actual document, meticulously gather the foundational components.

- Itemized product/service descriptions and associated pricing

- Customer details like legal name, contact info, and shipping address

- Your company’s legal name, address, phone number, tax ID

Having this information thoroughly organized streamlines creating a cohesive invoice.

Leveraging Technology – Exploring Invoice Automation Solutions

Technology now enables businesses to automate and optimize invoicing through dedicated software designed to simplify billing and payment tracking. Benefits include.

- Invoice customization features to match company branding

- Data syncing across accounting platforms

- Payment integration and tracking

- Invoice scheduling and reminders

- Analytics on cash flow and profits

For maximum efficiency, evaluate your invoicing volume and needs to determine if automation is advantageous.

Ensuring Accuracy – The Importance of Proofreading Before Sending

Despite having excellent templates or software, human error can still occur. Proofread completed invoices closely to confirm all details are accurate before sending them to clients. Double check.

- Item descriptions, quantities, and pricing

- Calculations across subtotals, taxes, discounts, and final totals

- Payment due dates based on terms

- Customer contact and shipping information

Catching errors early preserves professionalism, facilitates timely payment, and avoids costly misunderstandings.

Addressing Common Invoice-Related Questions

Now that we have covered creating professional invoices, let’s explore some frequent customer questions.

Understanding Payment Timeframes – Demystifying Invoice Due Dates

Many customers wonder about typical invoice payment terms and due date expectations across different industries. While specific timeframes vary, standard payment periods range between 30 to 60 days from the invoice date. Customers should clarify directly with sellers to confirm policies.

Early Payment Incentives – Unveiling Early Payment Discounts

Sometimes customers are offered payment discounts for clearing invoices quicker than standard due dates. Businesses extend these incentives to accelerate cash flow while rewarding prompt-paying customers. Typical discounts range from 2% to 10% for payments issued within 10 days of invoicing.

Resolving Discrepancies – What to Do in Case of Invoice Issues

Despite best efforts, occasional invoice disputes arise. If customers identify issues regarding invoice amounts, product/service descriptors, quantities billed for, or have general clarification questions, they should contact the seller quickly before the payment deadline. Most reputable businesses promptly address discrepancies to avoid misunderstandings.

Effective Invoicing Through Versa Cloud ERP

Crafting professional invoices and systematically tracking them to facilitate timely payments from clients requires finesse. However, manually managing these financial intricacies across growing customer bases quickly becomes unwieldy without support.

Versa Cloud ERP provides a robust, affordable cloud-based solution built specifically to bolster accounting, invoicing, payment tracking, and financial analytics for enterprises worldwide.

By centralizing billing details and synchronizing data across integrated ledgers, Versa Cloud ERP gives finance and accounting leaders 360-degree financial visibility along with tools to create detailed invoices, automate reminders for outstanding payments, and provide client portals for self-service access.

Leverage Versa Cloud ERP to truly transform your invoicing process efficiency while unlocking real-time financial insights to drive data-backed growth strategies. Schedule a free customized demo today to discover how Versa Cloud ERP can optimize business scalability through enterprise-grade financial management.

To combat the limitations of a Traditional ERP, Cloud ERP solutions provide greater agility, scalability, and cost-effectiveness, making them increasingly popular choices for modern businesses looking to streamline their operations and stay competitive in today’s fast-paced digital landscape.

Schedule a free demo of Versa Cloud ERP with our experts to see if it fits your brand’s unique needs. Our team offers affordable tailored customization packages to provide a smooth onboarding experience. Versa Cloud ERP deserves a look for organizations that value reliability, flexibility, and simplicity.

Effectively manage your financials, accounting, inventory, production, warehouse management, order management, and other operations of your Shopify Store workflows with our award-winning ERP.

Let Versa Cloud Erp’s do the heavy lifting for you.

Empower your business with the knowledge to navigate the realm of an Integrated ERP solution. This comprehensive guide will give insights, streamline processes, and propel your accounting management to new heights.

With Versa Cloud ERP’s Implementation guide learn how a business can ensure a successful ERP Solution Implementation. Navigate the complexities of implementation with confidence!

A Small Business in the modern day with Omnichannel Retail is complex and requires resources to deliver on its goals and achieve its full potential. To create a small business success story business owners need an ERP Solution that grows with them.

Do Business on the Move!

Make your businesses hassle-free and cut the heavyweights sign up for the Versa Cloud ERP today!!

Join our Versa Community and be Future-ready with us.