Effective inventory costing is essential for inventory accounting in an ERP for businesses to accurately assess their inventory valuation, manage costs, and make informed strategic decisions.

Maintaining a consistent inventory flow is crucial for a business. Every business aims for seamless operations, satisfied customers who keep coming back for more, and, naturally, consistent profitability.

Businesses need to maintain a stock of products and their value for financial reporting and tax purposes. For this, the business must calculate the cost of the inventory they sell or have sold. An ERP Solution with an Accounting feature can help users manage inventory and revenue generated from their sales. It assists in determining the quantity of products in stock, tracking orders, managing budgets, updating the list of goods, and forecasting profits.

However, it cannot be expected that a one-size-fits-all approach can be used for calculating the cost of the Inventory. There are mainly 3 methods used for calculating the cost of Inventory:

- First in First Out (FIFO)

- Last in First Out (LIFO)

- Average Costing

Essentials of Accounting: Why is Inventory Costing important?

Inventory costing is crucial for several reasons, deeply intertwined with the financial health and decision-making processes of a business.

-

Accurate Financial Reporting

Inventory represents a significant portion of a company’s assets. Properly valuing inventory ensures that financial statements accurately reflect the true value of these assets. This is essential for stakeholders, including investors, lenders, and regulators, to make informed decisions about the company’s financial health and performance.

-

Profit Determination

The cost of inventory directly impacts the calculation of the cost of goods sold (COGS), a key component in determining a company’s gross profit. Accurate inventory costing ensures that profits are accurately calculated, providing insights into the profitability of products and overall business operations.

-

Tax Compliance:

Inventory valuation methods directly influence the amount of taxable income reported by a business. Different inventory costing methods, such as FIFO (first-in, first-out) or LIFO (last-in, first-out), can result in different tax liabilities. Choosing the most appropriate costing method can help minimize tax expenses while remaining compliant with tax regulations.

-

Budgeting and Planning

Inventory costing provides valuable information for budgeting and planning purposes. By understanding the cost of inventory, businesses can better forecast future expenses, manage cash flow, and make strategic decisions about purchasing, pricing, and production levels.

- Preventing Stockouts and Overstocking

Accurate inventory costing helps businesses maintain optimal inventory levels. By understanding the true cost of inventory, businesses can avoid stockouts (running out of inventory) that can lead to lost sales and dissatisfied customers, as well as overstocking, which ties up capital and storage space unnecessarily.

-

Inventory Management

Inventory costing methods influence inventory management practices, such as reorder points, safety stock levels, and inventory turnover ratios. Businesses can use costing information to streamline their inventory management processes, reduce carrying costs, and improve overall efficiency.

In summary, inventory costing is essential for financial transparency, profitability analysis, tax compliance, strategic decision-making, and efficient inventory management. By accurately valuing inventory, businesses can enhance their financial performance, minimize risks, and maintain a competitive edge in the marketplace.

Essentials of Accounting for Inventory: First in First Out (FIFO)

FIFO (First In, First Out) assumes the first goods purchased are the first goods sold. Products are typically sold in the order they are received into inventory, indicating that the earliest items acquired are the first ones to be sold.

In addition, ending inventory is costed at newer, higher prices paid recently. FIFO generally results in higher net income and higher inventory balances than LIFO during inflationary periods. This method is primarily used for managing perishable such as medical supplies, pharmaceuticals, and other consumables to ensure that products with a limited shelf life are used in the order they were received.

It is based on the principle that the cost of goods sold should reflect the actual cost of acquiring the inventory. By selling the oldest inventory first, FIFO typically results in a more accurate matching of costs with revenues. This can be particularly beneficial during periods of rising prices, as it tends to result in lower COGS and higher reported profits compared to other inventory valuation methods.

Advantages of FIFO

- Accurate Cost Matching: FIFO generally provides a closer match between the cost of goods sold (COGS) and current market prices because it assumes that the oldest inventory items are sold first. This results in a more accurate representation of profitability.

- Simple and Easy to Understand: FIFO is straightforward to implement, making it accessible for small businesses and those with limited accounting expertise. It involves minimal calculations and is less prone to errors compared to other methods.

- Tax Advantages: FIFO can result in lower taxable income and tax liabilities during periods of rising prices, as it typically values inventory at lower historical costs. This can lead to tax savings for businesses.

- Better Reflects Physical Flow: FIFO closely mirrors the actual physical flow of inventory in many industries where products have a short shelf life or are perishable. It aligns with common business practices and is intuitive for managers and employees to understand.

Disadvantages of FIFO

- Distorted Profit Margins: During periods of inflation or rising costs, FIFO may overstate profitability by assigning lower costs to goods sold. This can result in inflated gross profit margins and may mislead stakeholders about the true financial performance of the business.

- Potential for Obsolescence: Since FIFO assumes that the oldest inventory items are sold first, it may result in newer, higher-cost items remaining in inventory for longer periods. This increases the risk of obsolescence, particularly for products with short lifecycles or frequent updates.

- Complexity in Tracking: While FIFO is simpler compared to other inventory valuation methods, it can still be challenging to track inventory movements accurately, especially in businesses with large inventories or multiple locations. Maintaining detailed records is essential to ensure compliance and accuracy.

- Higher Tax Burden in Deflationary Environments: In contrast to its advantage during inflationary periods, FIFO can lead to higher tax burdens during deflationary environments. This is because it values inventory at higher historical costs, resulting in lower COGS and potentially higher taxable income.

Impacts of Using FIFO as an Inventory Costing Method

- Results in higher balance sheet inventory valuations

- Reports higher net income in times of rising prices

- Causes higher income taxes owed compared to LIFO

Essentials of Accounting for Inventory: Last in First Out (LIFO)

LIFO, or Last In First Out, is another method of inventory valuation used by businesses to determine the cost of goods sold (COGS) and the value of ending inventory. Unlike FIFO, LIFO assumes that the most recently acquired inventory items are sold first, with older inventory items remaining in stock.

LIFO increases the cost of goods sold (COGS) during periods of rising prices. Ending inventory is valued on the balance sheet at older, lower historical costs. This is used extensively in the retail, automotive, and manufacturing industries where rising costs are common. It is also favored by some companies for strategic tax planning purposes. The key disadvantage is it can result in older, obsolete inventory accumulating on the books.

Advantages of LIFO

- Reflects Current Costs: LIFO typically results in a closer match between the cost of goods sold and current market prices, especially during periods of inflation or rising costs. This can provide a more accurate representation of profitability by reflecting the higher costs of replacing inventory.

- Tax Advantages: LIFO can lead to lower taxable income and tax liabilities during periods of inflation, as it assigns higher costs to goods sold, thereby reducing reported profits. This can result in tax savings for businesses, particularly in industries with significant inventory turnover.

- Reduces Tax Impact of Inflation: By expensing the most recent, higher-cost inventory first, LIFO can mitigate the impact of inflation on taxable income. This can help businesses manage their tax burdens more effectively in environments where inflation erodes the purchasing power of profits.

- Better Matches Revenue and Expenses: LIFO can align more closely with the matching principle of accounting by matching the cost of goods sold with the revenues they generate. This can provide a clearer picture of the true profitability of a business in periods of changing costs.

Disadvantages of LIFO

- Distorted Financial Statements: LIFO can distort financial statements by understating the value of ending inventory and overstating cost of goods sold, particularly during periods of inflation. This can lead to lower reported assets and profitability, potentially impacting investor perceptions and lending decisions.

- Increased Tax Complexity: LIFO requires businesses to maintain detailed records of inventory purchases and costs, as well as comply with specific tax regulations governing its use. This can add complexity to tax reporting and increase administrative burdens, especially for businesses with large inventories or multiple locations.

- Inventory Liquidation Risks: LIFO can create inventory liquidation risks, where older, lower-cost inventory items may remain in stock indefinitely, leading to inventory obsolescence or write-downs. This can result in losses if inventory cannot be sold at prices sufficient to cover replacement costs.

- Non-Conformity with International Standards: LIFO is not permitted under International Financial Reporting Standards (IFRS) and is used less frequently in countries outside the United States. This can limit the comparability of financial statements across jurisdictions and may require adjustments for multinational companies.

LIFO offers advantages such as reflecting current costs, tax benefits during inflationary periods, and better matching of revenue and expenses.

Impacts of Using LIFO as an Inventory Costing Method

- Lowers taxable income in times of inflation

- Reduces ending inventory balances on the balance sheet

- Can lower COGS and increase net income during deflationary periods

Essentials of Accounting for Inventory: Average Costing Method

The average costing method for inventory valuation is a technique used by businesses to determine the cost of goods sold (COGS) and the value of ending inventory.

Under this method, the cost of each unit of inventory is calculated as the average cost of all units in stock. This is done by dividing the total cost of inventory (the sum of all purchase costs) by the total number of units in stock. The average cost per unit is then used to calculate the cost of goods sold and the value of ending inventory.

This method smooths out price fluctuations by spreading the impact of price changes across all units in stock, making it particularly useful in industries with stable inventory costs or where specific identification of inventory units is impractical.

Advantages of the Average Costing Method

- Simplicity: Average costing is straightforward and easy to implement, requiring minimal calculations compared to other inventory valuation methods such as FIFO or LIFO. This makes it accessible for businesses with limited accounting expertise or resources.

- Smooth Out Price Fluctuations: By calculating the average cost of all inventory units, the average costing method spreads the impact of price fluctuations across all units in stock. This helps to mitigate the effects of sudden price increases or decreases on the cost of goods sold (COGS) and ending inventory values.

- Consistency: The average costing method promotes consistency in inventory valuation by using the same calculation method for all inventory items. This ensures that financial statements remain comparable over time and across different accounting periods.

- Applicability to Homogeneous Inventory: Average costing is particularly suitable for businesses with homogeneous inventory items, where individual units are identical or similar in nature. It provides a practical approach to valuing inventory when specific identification of inventory units is impractical or unnecessary.

- Reduction of Administrative Burden: Since average costing involves calculating the average cost of all inventory units, it reduces the administrative burden associated with tracking individual costs for each unit. This can save time and resources for businesses, especially those with large inventories.

Disadvantages of the Average Costing Method

- Distorted Valuations: One drawback of the average costing method is that it can result in distorted inventory valuations, especially during periods of significant price fluctuations. Since all units are valued at the same average cost, the method may not accurately reflect the true replacement cost of inventory.

- Potential Over or Understatement of Profits: Depending on the timing of inventory purchases and price changes, the average costing method may lead to over or understatement of profits. This can impact decision-making and financial analysis, as well as investor perceptions of a company’s performance.

- Inaccuracy in High-Volume Transactions: In industries with high-volume transactions or rapid inventory turnover, the average costing method may not provide precise cost allocations for individual inventory items. This can lead to inaccuracies in cost of goods sold calculations and inventory valuations.

- Lack of Specific Identification: The average costing method does not allow for specific identification of inventory units, which may be necessary for certain industries or for specific inventory management purposes. Businesses requiring precise tracking of inventory costs for regulatory compliance or quality control purposes may find this limitation restrictive.

Impacts of Using Average Cost as an Inventory Costing Method

- Smooths changes in inventory costs between periods

- Avoids distortions of LIFO and FIFO during price swings

- Reduces tax planning flexibility compared to LIFO

Versa Cloud ERP’s Accounting Feature for Inventory Costing

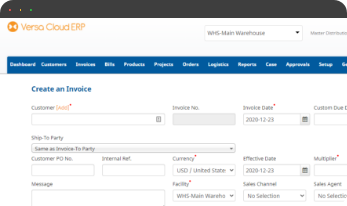

Versa Cloud ERP’s Accounting feature offers highly configurable solutions supporting LIFO, FIFO, and average costing within a unified platform. Our solution is designed to streamline operations for manufacturing, wholesale distribution, retail, and service industries globally.

To learn more about how Versa’s versatile platform can accommodate your organization’s unique accounting and tax requirements, please schedule a free customized demonstration today. The accounting feature in Versa Cloud ERP offers a comprehensive set of tools and functionalities to streamline accounting processes, improve financial visibility, and support informed decision-making for businesses of all sizes.

Empower your business with the knowledge to navigate the realm of an Integrated ERP solution, specifically tailored to inventory and warehouse management and POS needs. Gain insights, streamline processes, and propel your financial management to new heights with this comprehensive guide

With Versa Cloud ERP’s Implementation guide learn how a business can ensure a successful ERP Solution Implementation. Navigate the complexities of implementation with confidence!

A Small Business in the modern day with Omnichannel Retail is complex and requires resources to deliver on its goals and achieve its full potential. To create a small business success story business owners need an ERP Solution that grows with them.

Effectively manage your financials, accounting, inventory, production, and warehouse management workflows with our award-winning ERP.

Let Versa Cloud Erp’s do the heavy lifting for you.

Do Business on the Move!

Make your businesses hassle-free and cut the heavyweights sign up for the Versa Cloud ERP today!!

Join our Versa Community and be Future-ready with us.