Transform your Shopify store with integrated ERP solutions for comprehensive financial reporting.

With over a million e-commerce businesses powered globally by Shopify, understanding its financial reporting requirements is pivotal for online merchants to scale sustainably.

However, Shopify users often struggle with several commerce accounting challenges unique to managing integrated stores with subscription revenue models. These include obstacles like consolidating fragmented financial data across multiple sales channels, recognizing deferred subscription earnings correctly, tracking convoluted inventory costs using drop shipping, and more.

These problems are further compounded by complicated sales tax calculations given Shopify’s geographically dispersed merchant base combined with a lack of internal accounting expertise among smaller merchants.

This comprehensive guide aims to finally help unravel key Shopify accounting mysteries that often baffle users. It explores some critical recurring financial reporting challenges, best practices e-commerce merchants can deploy for accurate books and common questions frequently posed around subscription revenue recognition, cost of goods sold, multi-location inventory management, taxes, and beyond.

With actionable recommendations around revenue booking, cost allocation, data consolidation, tax compliance, and tips for leveraging and integrating accounting platforms, we hope to empower Shopify retailers to optimize their profitability, cash flows, and long-term success through robust financial oversight.

So let’s get started deciphering Shopify’s crucial yet confounding financial statements first!

Deciphering Key Shopify Financial Statements

As an e-commerce platform with a recurring fee structure, Shopify’s financial reports differ from traditional retailers. Three key financial statements for understanding any Shopify business are:

1. Income Statement

Also called Profit and Loss (P&L) report, this statement summarizes total revenues earned and expenses incurred over a period. For Shopify, subscription fees paid to use the platform need to be represented correctly.

2. Balance Sheet

The balance sheet presents a snapshot of an organization’s assets, liabilities, and equity at any point. For Shopify merchants, this covers inventory, cash, accounts receivable/payable, loans, and owner’s equity details.

3. Cash Flow Statement

This document tracks the inflow and outflow of cash classified into operating, investing, and financing activities. It gives visibility into a Shopify business’ liquidity to meet obligations.

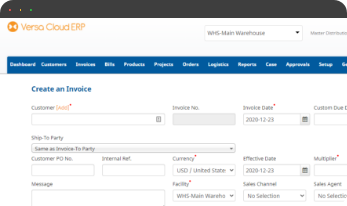

Versa Cloud ERP with its Financial feature gives access to Shopify businesses to its inbuilt financial reports which enable quick decision making. Data is all available in one platform and the reports generated from that data are also available on the same platform.

Top Shopify+ERP Accounting and Reporting Pain Points

Despite offering a robust e-commerce platform, several nuanced accounting issues perplex Shopify entrepreneurs.

1. Recognizing Subscription Revenue

With monthly recurring fees, Shopify revenue cannot be recognized upfront and must be incrementally deferred over each period based on the contract term. This creates complexity in financial reporting.

2. Multi-Channel Sales Consolidation

Sales data fragmentation across online stores, retail POS systems like Shopify POS, buying channels like Amazon, and even wholesale creates reporting inconsistencies and inventory reconciliation issues.

3. Cost of Goods Sold Challenges

For drop-shipped items, merchants incorrectly assign $0 COGS despite not holding inventory. However, listing supplier costs as COGS is vital for accurate inventory valuation and margins.

4. Sales Tax Complexities

With online firms having customers across geographies, applying accurate tax rules and rates for each jurisdiction is extremely complicated, and non-compliance risks loom.

5. Expense and Cost Allocation

Beyond COGS, allocating indirect costs like marketing, branding, packaging, and payment processing appropriately across products and channels impacts accounting accuracy.

Shopify+ERP Financial Reporting Best Practices

By deploying well-defined accounting frameworks, automation tools, and outsourced services, Shopify users can adopt healthier financial reporting standards.

1. Bank Reconciliation

Frequent reconciliation between Shopify payments received, bank deposits, and accounting books aids accuracy. Sales tax payments and liabilities also need close coordination.

2. Consolidated Reporting

Enterprise financial software like NetSuite enables unified reporting across sales channels, locations, and product lines for consistent numbers.

3. Accounting Automation

Automating routine tasks like transaction matching, financial statement generation, and invoice creation improves productivity while enabling real-time monitoring.

4. Clear Accounting Rules

Well-documented policies for cost allocation, revenue recognition, and inventory flow methods (FIFO, LIFO, etc) prevent inconsistencies and rework.

5. Regular Analytics Reviews

Analyzing key metrics around sales, costs, profits, margins, etc periodically guides strategic decisions using Shopify or third-party BI tools.

6. Outsourced Accounting

Leveraging managed bookkeeping services from a Shopify-savvy provider enables smoother workflows, financial health checks, and tax compliance.

Consolidating the Financial Picture of Shopify with Versa Cloud ERP

As Shopify merchants grow into multi-channel sellers supporting both D2C and B2B models, they need an integrated view of their finances to make strategic decisions. Combining data from separate applications like Shopify, Amazon, accounting platforms or POS systems makes reporting inconsistent.

This is why businesses trust Versa Cloud ERP for real-time visibility into their numbers. Purpose-built for e-commerce and retail, Versa Cloud ERP seamlessly consolidates financial data across sales channels into a single ledger. This provides an accurate picture of revenues, costs, profits, and margins in one dashboard.

With AI-driven analytics also built in, merchants get a unified view of performance across product lines, stores, and global operations. User-friendly workflows further aid in managing inventory, orders, accounting, supply chain logistics, and customer engagement from a unified platform.

So take control of your finances today with Versa Cloud ERP designed for the new-age merchant’s omnichannel needs!

Empower your Shopify business with the knowledge to navigate the realm of an Integrated ERP solution, specifically tailored to logistics, inventory and warehouse management, and POS needs. Gain insights, streamline processes, and propel your financial management to new heights with this comprehensive guide

With Versa Cloud ERP’s Implementation guide learn how a business can ensure a successful ERP Solution Implementation. Navigate the complexities of implementation with confidence!

A Small Business in the modern day with Omnichannel Retail is complex and requires resources to deliver on its goals and achieve its full potential. To create a small business success story business owners need an ERP Solution that grows with them.

Effectively manage your financials, accounting, inventory, production, logistics, and warehouse management workflows with our award-winning ERP.

Let Versa Cloud Erp’s do the heavy lifting for you.

Do Business on the Move!

Make your businesses hassle-free and cut the heavyweights sign up for the Versa Cloud ERP today!!

Join our Versa Community and be Future-ready with us.