Feeling lost in spreadsheets? Discover the Essentials of an Accounting function in an ERP with this series.

In today’s dynamic business environment, maintaining a strong financial footing is crucial. This is where an all-in-one ERP solution and accounting come together to empower your organization. ERP systems provide a central platform to streamline various operations, including accounting tasks. ERP Solutions with an Accounting function software, dives deeper into the financial aspects, allowing you to record transactions, generate insightful reports, and ensure regulatory compliance. By integrating these two powerful tools, you gain a holistic view of your financial health and make data-driven decisions for sustainable growth.

This article series of Versa Cloud ERP will cover the Essentials of Accounting and the first thing we will cover is the Chart of Account

Essentials of Accounting in an ERP: Chart of Accounts in an

A Chart of Accounts (COA) is essentially a filing cabinet for your business’s financial transactions

It is a structured list of all the financial accounts used by a business or organization. Each account is typically assigned a unique number or code and is categorized according to its type, such as assets, liabilities, equity, revenue, and expenses. The COA provides a systematic way to organize and track financial transactions, making it easier to generate financial statements, analyze financial performance, and prepare tax returns. It serves as the foundation for the accounting system and ensures consistency and accuracy in financial reporting.

Here are some key points about a chart of accounts:

- Provides Organization: By grouping transactions into categories, the COA makes it easier to track your income and expenses, and see the overall financial health of your business.

- Ensures Accuracy: When everyone uses the same account names consistently, it reduces errors and makes your financial data more reliable.

- Enables Reporting: The COA is the foundation for generating financial reports, like your income statement and balance sheet.

Essentials of Accounting in an ERP: 5 Categories of Accounts

Sure, here are five basic categories commonly found in a chart of accounts:

- Assets: This category includes all the resources owned by the business that provide future economic benefits. Examples of asset accounts include cash, accounts receivable, inventory, property, plant, and equipment.

- Liabilities: Liabilities represent the obligations of the business to external parties. This category includes accounts such as accounts payable, loans payable, accrued expenses, and deferred revenues.

- Equity: Equity accounts reflect the ownership interest in the business. This category typically includes accounts such as owner’s equity for sole proprietorships or partnerships, and common stock and retained earnings for corporations.

- Revenue: Revenue accounts capture the income generated by the business through its primary operations. Examples of revenue accounts include sales revenue, service revenue, interest income, and rental income.

- Expenses: Expenses represent the costs incurred by the business to generate revenue. This category includes accounts such as cost of goods sold, salaries and wages, rent expense, utilities expense, marketing expenses, and depreciation expense.

These five categories provide a foundational framework for organizing financial transactions and preparing financial statements within an accounting system. Additional accounts can be added as needed to accommodate the specific requirements of the business.

Essentials of Accounting in an ERP: How Chart of Accounts Work?

The chart of accounts serves as the blueprint for organizing and categorizing financial transactions within an accounting system. Here’s how it works:

- Organization and Structure: The chart of accounts is typically structured hierarchically, with each account assigned a unique number or code for easy identification. Accounts are organized into categories such as assets, liabilities, equity, revenue, and expenses.

- Recording Transactions: When a financial transaction occurs, such as a sale, purchase, or expense, it is recorded in the appropriate account within the chart of accounts. For example, a sale would be recorded as an increase in the revenue account, while a purchase would be recorded as an increase in an expense account.

- Double-Entry Accounting: The chart of accounts follows the principles of double-entry accounting, meaning that every transaction affects at least two accounts. For example, when a sale is recorded, revenue increases in one account while either cash or accounts receivable increases in another account.

- Financial Reporting: The chart of accounts provides the foundation for generating financial statements, such as the balance sheet, income statement, and statement of cash flows. These statements summarize the financial activities of the business and provide valuable insights into its financial health and performance.

- Analysis and Decision-Making: By organizing financial data into categories and accounts, the chart of accounts enables businesses to analyze trends, track expenses, and make informed decisions. It allows stakeholders to assess the profitability of different products or services, identify areas for cost savings, and evaluate the overall financial position of the business.

Essentials of Accounting in an ERP: Best Practices

Over time, several practices have been developed that have proven effective for companies when developing their initial charts of accounts:

1. Adopt a basic structure that aligns with the business’s financial reporting requirements.

2. Maintain a clear separation between balance sheet and income accounts, ensuring they correlate where necessary. For instance, if the company has debts, include both debt liability and interest expense accounts in the chart of accounts.

3. Organize the chart of accounts to facilitate management decision-making by defining account types based on the business’s operational structure. Ensure the chart provides a transparent overview of cash inflows and outflows, aligning with budget categories for easy performance evaluation.

4. Utilize structured codes and subheadings to swiftly extract essential information. A five-digit structured code offers sufficient granularity for multiple levels in the chart of accounts, leaving room for expansion when required.

5. Leverage modern accounting software, particularly cloud-based solutions, which can enrich transaction details to substitute for additional levels in the chart of accounts, simplifying complex coding schemes.

6. Avoid excessive detail to maintain clarity. Strive to understand financial activities without becoming overwhelmed by minutiae. If the chart of accounts exceeds three levels, consider implementing sub-ledgers to manage complexity.

7. Amend the chart of accounts exclusively at the end of reporting periods. Minimize alterations whenever possible, ensuring changes are made only at period-ends to preserve data integrity and consistency throughout accounting periods.

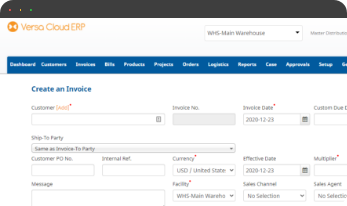

Versa Cloud ERP and Accounting

Versa Cloud ERP offers a simple and straightforward Accounting Solution for Small Businesses:

- Multi-Entity Multi-Currency Support

- Bank Integration and Reconciliations

- Import and Exports of Journal Entries

In addition, Versa also supports financial capabilities included in the core ERP module:

- General Ledgers

- Accounts Receivables/Accounts Payables

- Cash Management

- Asset Management

- Purchase to Pay

- Quote to Cash

Essentials of the Accounting Feature in Versa Cloud ERP

When establishing a chart of accounts from scratch, it’s crucial to consider the operational aspects of the business, rather than solely focusing on compliance with legal and tax requirements. Questions such as the number of business divisions, typical expenses, and types of assets, including intangible assets, should be pondered.

Versa Cloud ERP enables businesses to have the flexibility to include as many accounts as necessary in the chart of accounts to capture a comprehensive overview of the company’s financial activities. When setting up the chart of accounts, it’s essential to consider potential financial analyses that may be required. Once established, the chart of accounts should remain unchanged.

During implementation, a business can adjust the structure of the chart of accounts to meet their needs better.

Essentials of the Accounting Feature in Versa Cloud ERP: How to Set up Chart of Accounts

Versa Cloud ERP enables users to Import Chart of Account details from their previous system or Create a Chart of Accounts in Versa directly.

Essentials of the Accounting Feature in Versa Cloud ERP: Reporting Groups

- Current assets

- Long-term investments

- Fixed assets (or Property, Plant, and Equipment)

- Intangible assets

- Other assets

- Current liabilities

- Long-term liabilities

- Shareholders’ equity

A business is free to define as many account groups as required and specify the ordering of the groups when they appear on financial reports. These reporting groups list all the various GL accounts a business maintains. Below are a few examples of the list of accounts under a reporting group:

Users can add GL Accounts under the reporting groups throughout the lifecycle of the business at any point.

Overall, the chart of accounts is a critical component of the accounting process, providing structure and organization to financial data and facilitating accurate and meaningful financial reporting and analysis.

Empower your business with streamlined accounting processes with Versa Cloud ERP.

With Versa Cloud ERP’s Implementation guide learn how a Manufacturing business can ensure a successful ERP Solution Implementation. Navigate the complexities of implementation with confidence!

A Small Business in the modern day with Omnichannel Retail is complex and requires resources to deliver on its goals and achieve its full potential. To create a small business success story business owners need an ERP Solution that grows with them.

Effectively manage your financials, accounting, inventory, production, and warehouse management workflows with our award-winning ERP.

Let Versa Cloud Erp’s do the heavy lifting for you.

Do Business on the Move!

Make your businesses hassle-free and cut the heavyweights sign up for the Versa Cloud ERP today!!

Join our Versa Community and be Future-ready with us.